As a result of a partnership with Noah, freelancers, creators, and sellers can receive ACH/SEPA transfers in USD or EUR directly in MiniPay, convert instantly to stablecoins, and cash out locally to familiar methods like mobile money, M-Pesa, Pix, GCash, Shopee, and more.

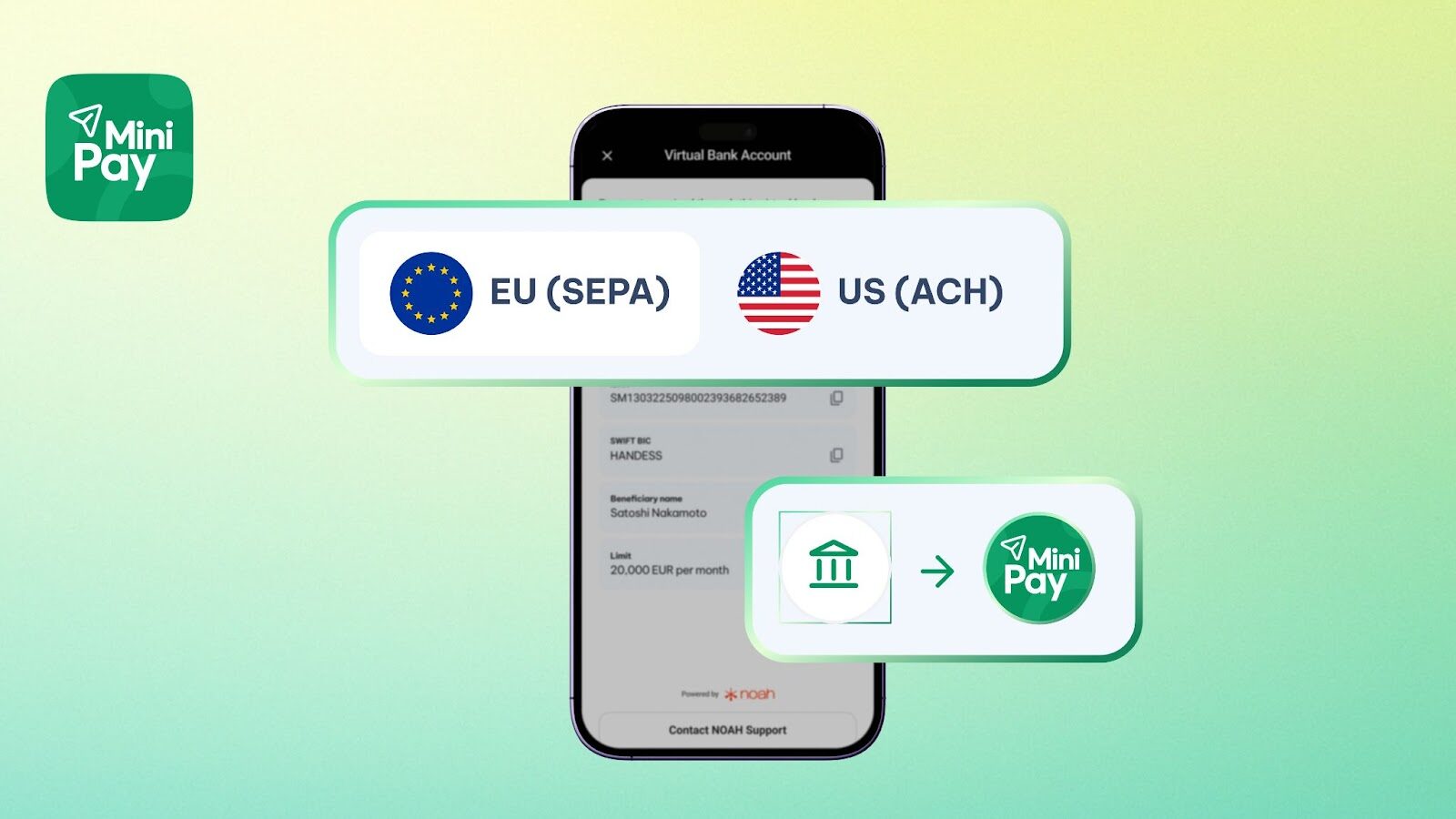

Oslo, Norway – October 8, 2025 – MiniPay now lets users receive USD and EUR payments via bank transfers and access their money instantly anywhere. With new virtual ACH and SEPA account details, global payouts land in MiniPay and can be spent, saved, or withdrawn locally in minutes – once the payment lands in a MiniPay account, it can be withdrawn instantly. Built with global freelancers and creators in mind, this makes it easier than ever to get paid internationally, fast, with low fees, and in a self-custodial wallet you control.

The launch comes as freelance markets surge worldwide. Africa’s freelance tech sector alone is projected to grow from $7.3 billion in 2024 to $37.7 billion by 2034, while Latin America’s freelance platforms market is expected to more than triple by 2030, reaching $1.65 billion. In Southeast Asia, platforms are reporting double-digit growth, with the Philippines home to an estimated 1.5 million freelancers and Vietnam emerging as a regional tech powerhouse. South Asia continues to dominate the global online labor supply, with India accounting for 26% of activity and home to roughly 15 million freelancers.

With virtual accounts, eligible customers get U.S. and European receiving details they can share with clients, platforms, and marketplaces. When funds arrive, Mini Pay automatically converts the transfer into stablecoins, such as USDT by Tether, and settles the balance to the user’s wallet within moments, ready to spend, send, or withdraw. From the same balance, users can top up airtime, pay bills, redeem rewards, and check out in Mini Apps for everyday commerce, or cash out locally to familiar rails such as mobile money, Pix, GCash, or bank transfers. Value stays stable in the wallet until needed, making international payouts immediately useful in daily life.

Transparent pricing & fast payouts

MiniPay also signals cost clarity and speed. Deposit fees in inbound ACH/SEPA transfers are $0 in most supported markets upon launch. Settlement is fast – funds are auto-converted to stablecoins and typically ready to use within minutes after landing in the account – with no hidden fees: timing, routes, and any applicable charges are disclosed in-product.

“People want to get paid like a local – without the maze of cross-border fees and delays,” said Murray Spark, Head of Commercial at MiniPay. “By pairing USD/EUR virtual accounts with fast stablecoin conversion, transparent costs and local cash-out in a non-custodial wallet that keeps earnings in users’ control, MiniPay turns international earnings into everyday spending power.”

Powered by Noah’s infrastructure, MiniPay’s virtual accounts combine the reliability of local transfers, such as M-Pesa or Pix, with the speed and global reach of stablecoins.

“Money shouldn’t live on separate rails,” said Shah Ramezani, CEO of Noah. “By powering real-time interoperability between bank networks and digital assets, this partnership with MiniPay removes that divide – making global payments feel instant, connected, and built for the modern economy.”

Use cases at scale

Early use cases include a designer selecting “Direct to U.S. Bank” on a major marketplace like Amazon or Upwork and receiving a free ACH payout to MiniPay, then cashing out locally to mobile money the same day. Sellers using European marketplaces can share SEPA receiving details to consolidate payouts in MiniPay, keep value stable until needed, and use Mini Apps to buy airtime, pay bills, and collect rewards, covering daily expenses while retaining on-chain flexibility.

With freelancing economies in Mexico, Brazil, and Philippines alone projected to generate billions in additional cross-border flows by 2030, MiniPay’s ability to connect bank transfers, stablecoins, and local rails in a single flow makes it a vital tool for the future of work.

The launch extends MiniPay’s reach at consumer scale. Millions of people globally can now access direct ACH/SEPA receipts inside MiniPay’s familiar, mobile-first experience, bringing together bank transfers, stablecoins, and local rails in a single flow.

Virtual accounts have begun rolling out on iOS and Android, with market-by-market expansion to follow. Cash-out methods, limits, fees, and supported assets are disclosed in product and vary by market.

Download the latest version of MiniPay and join the waitlist to experience virtual accounts first hand! The access for the waitlist users will be activated in batches over the next few weeks to ensure a smooth, stable experience. Users on the waitlist should keep checking the “Deposit” section of MiniPay app.

About MiniPay

MiniPay is a non-custodial stablecoin wallet built on the Celo blockchain and offered by Blueboard Limited, an Opera company. MiniPay is designed to make digital finance accessible, affordable, and user-friendly – especially across emerging markets. Available as a standalone Android and iOS app, or as integrated into the Opera Mini browser, MiniPay enables users to send, receive, and save stablecoins like cUSD, USDC, and USDT with sub-cent fees, no gas management, and a phone number-linked experience. Since its launch in 2023, MiniPay has expanded to over 60 countries and surpassed 10 million activated wallets, making it one of the fastest-growing stablecoin wallets globally. Learn more at www.minipay.xyz

Disclaimer

As a non-custodial stablecoin wallet, MiniPay exclusively enables individual users to initiate on-chain P2P stablecoin transfers. Through integrations with our third-party partners, however, the MiniPay ecosystem also enables users to discover a rich array of additional services provided by such third parties including on-ramp/off-ramp, top-up, or payment services. MiniPay itself does not facilitate or provide any form of exchange services, payment services, or remittances. Any and all references to such functionality indicates the availability of third-party services discoverable within the MiniPay ecosystem.

About Noah

Noah builds the financial infrastructure that connects banks, payment networks, and digital finance. Its mission is to make modern finance interoperable – where value moves seamlessly between currencies, markets, and networks. Noah’s platform powers account issuance, settlement, and global payouts for partners across emerging and developed markets. Its products include Bank On-Ramp, Global Payouts API, Hosted Checkout, and Rules Engine, enabling compliant, real-time money movement worldwide. Noah is licensed as a VASP in the EU, registered as an MSB in the US and Canada, and holds 8 MTLs in the United States. Learn more at noah.com